salt tax deduction explained

Second the 2017 law capped the SALT deduction at 10000 5000 if. The 2017 tax reform aw limited the state and local tax SALT deductions at 10000 for the tax years 2018 through 2025.

Pass Through Entity Tax 101 Baker Tilly

The SALT deduction limit increase to 80000 was NOT.

. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. But you must itemize in order to deduct state and local taxes on your federal income tax return. The deduction went into effect during the 2019 tax year and included a cap of 10000.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local. In New York the deduction. Ways the SALT deduction cap can be offset for high earners.

As incomes rise the loss in deductions can also be offset by the decrease of the top federal income tax rate from. When did SALT deduction start. SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to itemize instead.

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025. Move from New York to Florida.

It allows those in high-tax states to deduct the money they spend on local and state taxes. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize. 52 rows The SALT deduction is only available if you itemize your deductions.

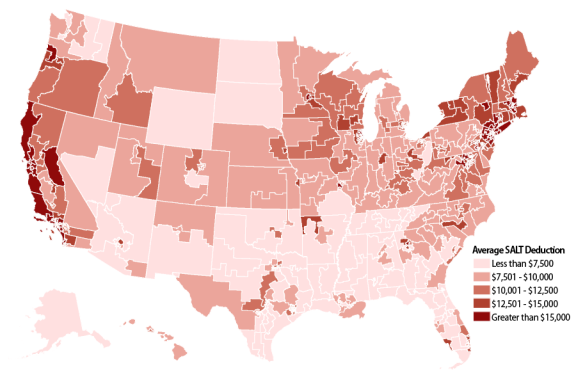

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President. The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. Blanca Ocasio-Cortez the mother of the new socialist superstar in Congress did what dozens of parents I know have done.

Legislation Introduced In U S House To Restore The Salt Deduction

Salt Deduction Resources Committee For A Responsible Federal Budget

The State And Local Tax Deduction A Primer Tax Foundation

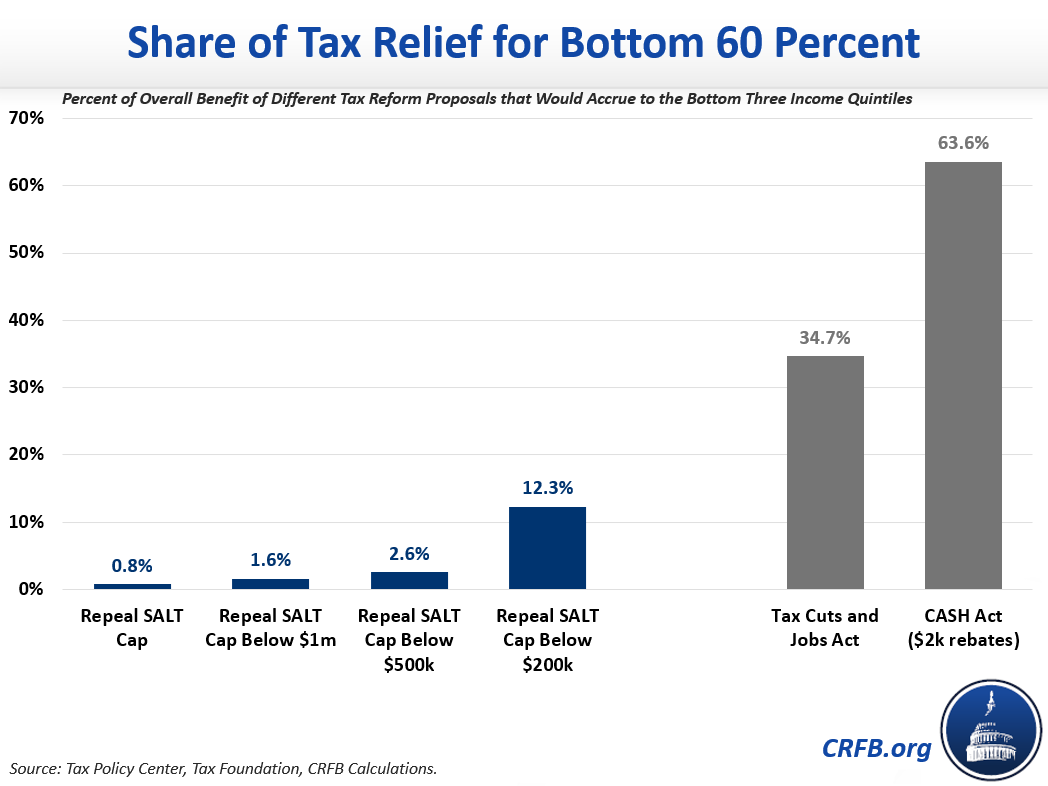

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Changes To The State And Local Tax Salt Deduction Explained

State And Local Taxes What Is The Salt Deduction

Ohio Income Tax Ohio Jumps On Trend To Codify Salt Deduction Cap Workaround Ohio State Tax Blog State And Local Tax Issues

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

The State And Local Tax Deduction Cap Explained Usafacts

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox